Safeguarding your customers from fraud before – and after – COVID-19

https://contactcentresummit.co.uk/wp-content/uploads/2019/07/Cyber-Attack.jpg 960 640 Guest Post Guest Post https://secure.gravatar.com/avatar/abb249055208c7af4d35568e422dfd63?s=96&d=mm&r=gBy Brett Beranek, VP & General Manager, Security and Biometrics at Nuance Communications

The spread of coronavirus has resulted in increased uncertainty for many. Even as we hopefully begin to see light at the end of the tunnel, feelings of ambiguity have triggered a variation of consumer behaviour. Some are plunging deeper into their work to stay productive and keep the feeling of development going. Others are ‘switching off’ from the news and current affairs by diving into box-sets. Many are calling their banks to check on payments, Direct Debits and seek reassurance.

Loitering behind the scenes of it all is an unfortunate reality often tied to uncertainty and associated behaviours – threat actors, also known as fraudsters. The sad truth is that fraudsters don’t stop their crimes because of a pandemic. In fact, they often seize the immense change that comes with an event like this to ramp up their activity. From social engineering to email phishing and the development of sophisticated – but bogus – websites, fraudsters are taking advantage of any guards down during this time.

During the initial phases of lockdown, we saw a huge increase in the volume of fraud attacks – ranging from 200% – 400%, depending on industry. Some of these relate directly to the pandemic and reports indicate there have been hundreds of coronavirus-related scams. With fraudsters now turning to track-and-trace apps in order to dupe individuals out of their data and hard-earned money, this is a number which is only likely to increase as we go on.

Last year, even before the impact of coronavirus hit, fraud reportedly cost the global economy $5 (USD) trillion. A global poll conducted by Nuance around the same time found nearly one in five (27%) UK consumers had fallen victim to fraud in the previous twelve months, losing an average of £1,000 each, due to inefficient passwords.

That fraud loss doesn’t just hit you and me, or the bank’s insurance premiums. It hits the firms unintentionally associated with the fraud. Customers are quick to move away from those associated to fraud when it happens, with three in five (60%) in the UK noting they would change service providers or brands if they fell victim to fraudsters through their services.

Safeguarding customers in the new normal

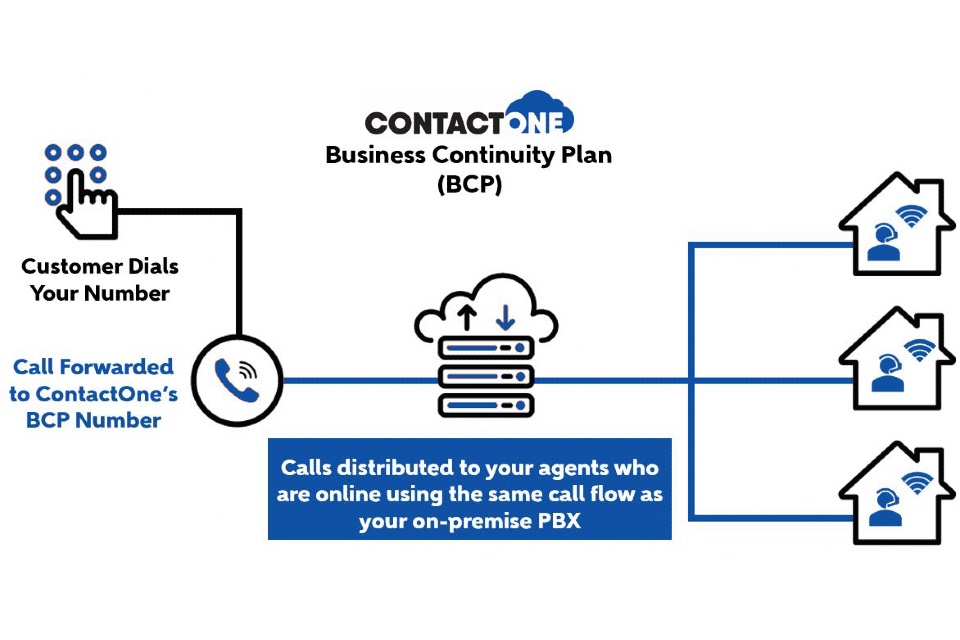

Over the last few months, businesses all over world have faced a myriad of challenges. Irrespective of size or sector, we’ve all needed to adapt in order to keep going. The early obstacles were around ensuring both connectivity and productivity, enabling employees to work effectively from home during this unprecedented period in history.

But securing this new home-based workforce and protecting every employee, as well as every customer, from fraud is still a major concern. Many are simply not prepared and do not have the latest safeguarding tools – such as biometric technologies – in place to shield themselves from financial loss and protect their customers from identity theft. In such an uncertain time, it’s never been more important for organisations to bolster their cybersecurity strategies and arm themselves with the technology to keep fraudsters at bay whilst maintaining usual levels of service.

The unsung heroes

The abrupt switch to home-working has put particular pressure on call centres – and their agents. Many have had little to no experience with enabling remote or home working environments and fraudsters are using this to their advantage – testing for vulnerabilities by directly attacking agents working from home or even pretending to be those agents to test for weaknesses in the wider business.

This would be a challenge enough in itself but those operatives are also having to manage a massive surge in customer call volumes at a global scale. The economic downturn has all but brought the travel and hospitality industries to their knees and customers are concerned about their finances. They have questions and – in a time when many physical banks and offices are only starting to reopen – they are turning to call centres for the answers. Banks in Ireland, for example, saw a 400% increase in contact centre calls, including an average of 7,000 calls a day from customers around mortgage-related concerns.

In today’s circumstances, it can be difficult for customer care agents to navigate the sheer volume of calls, let alone separate the fraudsters from the real customers requesting to make these transactions. This is where biometrics can help.

The biometric barrier

With your contact centre agents tackling higher demand than ever before, biometrics could play a key role in protecting both them and your customers. Not only can it verify and authenticate a caller using just the sound of their voice and behavioural characteristics – saving your agents from having to ask knowledge-based questions – but it can also flag known fraudsters who are attempting to deceive.

This in turn gives your customers peace of mind in terms of the security of their account, and also streamlines the process and customer experience when they’re in contact with your brand.

Unfortunately, the most at risk of fraud are the elderly, especially during this pandemic. Indeed, according to Age UK, an older person in England and Wales becomes a victim of fraud every 40 seconds. This is an issue we need to address as an industry – and technology is there to support this fight. In fact, the most advanced technologies can now also enable organisations to identify those over 65 years of age when calling, and prioritise them accordingly using the sound of their voice – helping protect those at increased risk and further improve their experience.

Biometric solutions are emerging as a key resource in the armory needed to fight against fraud, especially during the coronavirus crisis. Their ability to identify customers, agents and fraudsters alike are helping to keep bad actors at bay and ensure that contact centre connections are safe and secure. By investing in such measures, businesses are taking a proactive stance to safeguard their employees and customers, putting security at the heart of their customer experience.